With the advent of GST process from July 2017, many organizations have by now made their entire billing process in compliance with the GST. Definitely, there was a lot of scuffle during the initial stages for products and service companies to understand and implement the new GST model.

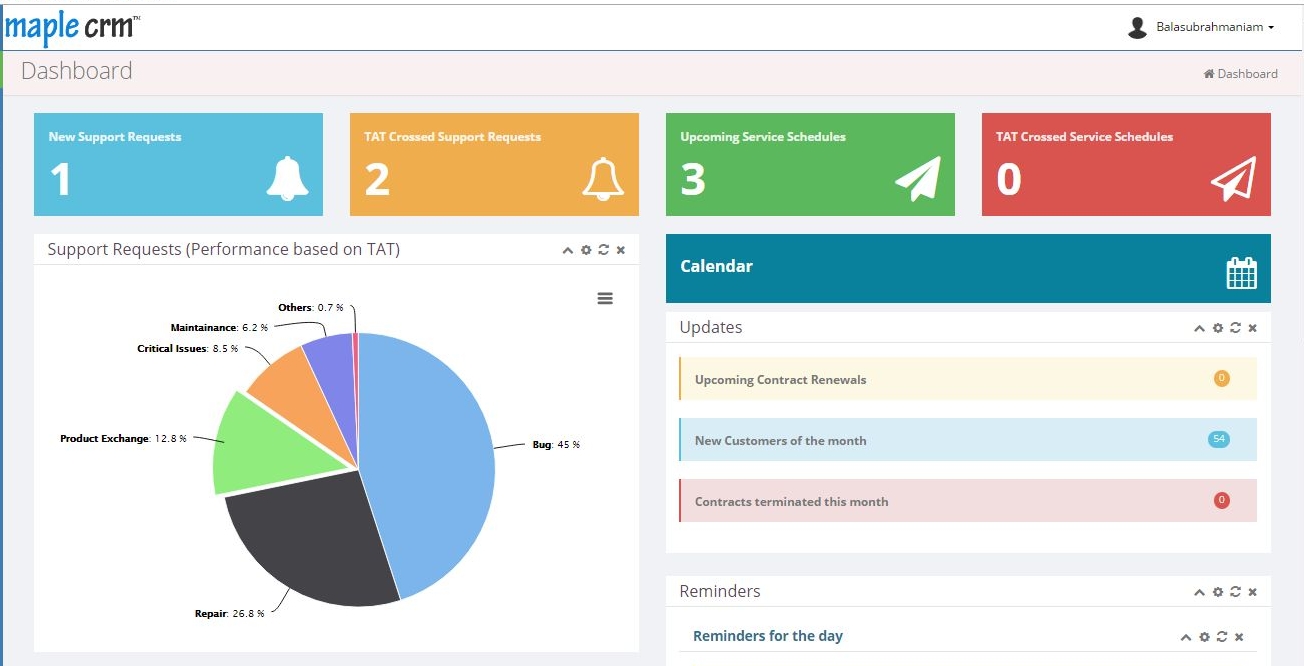

Maple CRM had introduced the GST based Invoice builder during those times which was developed to help organizations of different verticals to easily bill the customers using our system.

Maple CRM Invoice builder lets you to generate Proforma and Sales Invoice for Product Companies, Service Companies, etc.

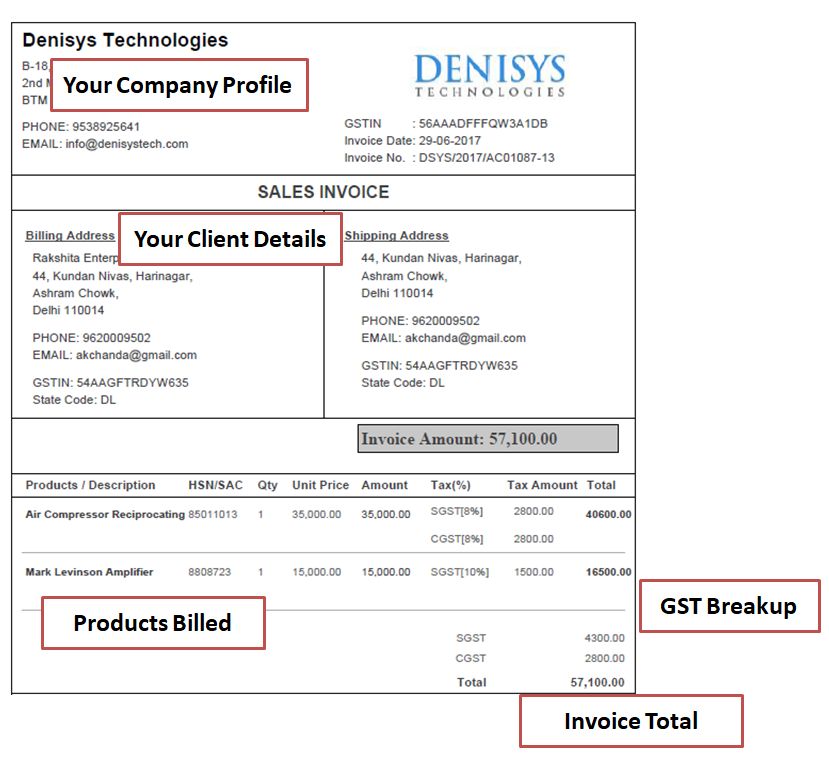

Sample GST Invoice for Product Companies

Below is a sample GST Invoice for Product Company where each product can vary with different tax rates.

Maple CRM offers simplified GST based Invoice Builder where you can configure different flavor based profiles i.e. Invoice templates that can be pulled accordingly when generating invoice for your client. Also, all the products can be uploaded under Product Catalogue for instant use. These products can be loaded with technical details of the product, standard unit price, HSN/SAC code and applicable tax rates (CGST, SGST and IGST).

While generating invoice for a client with the required product, once can choose what tax rates need to be applied and accordingly update the tax rates. The tax amounts along with the total invoice amount shall be automatically calculated. The generated invoice shall be available in PDF format which can be downloaded or emailed to the client from Maple CRM directly.

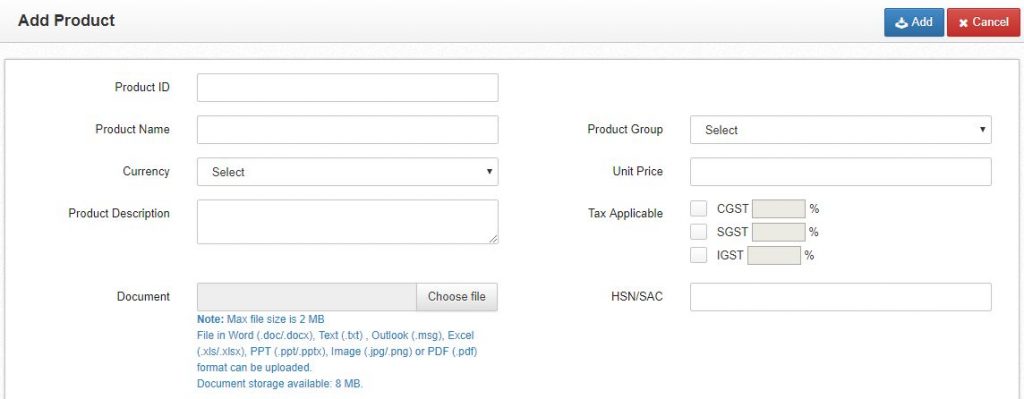

Configuring Products with GST rates

Below snapshot showcases the Product Addition form where one can enter all the product related details including HSN Code, Unit Price, Applicable tax rates, etc. Based on which, you can bill the customer by just selecting the product in the Invoice generation form.

Similarly, GST based invoices can be generated for Service Companies. For Service industry one can apply SAC code instead of HSN. You can easily generate invoices using Maple CRM in GST format in less than a minute.

Additionally, Maple CRM offers flavored predefined templates where you can have the PDF Invoice with the GST rates breakup on each product/service or the total GST calculation. Companies who do not fall under the GST model can opt for No GST template that will not include any of the GST details on it. This way, Maple CRM lets you to easily customize your business billing process as needed.

Check this video to understand more on Maple CRM Quotation Builder with GST.